For multinational companies, Asia Pacific remains the world’s most dynamic growth market, home to half the global population, rising middle classes, and economies that are increasingly central to global supply chains. Yet behind the region’s economic promise lies a quieter operational reality. APAC is one of the hardest parts of the world to maintain a compliant legal entity. What looks like routine corporate housekeeping in the United States or Europe becomes a relentless exercise in administrative resilience.

Country | Key Issues at Formation | Key Issues in Ongoing Maintenance |

|---|---|---|

Hong Kong | • Requirement for local company secretary • Bank account opening delays due to enhanced AML checks • Physical address required for registered office | • Annual Return filing and statutory register upkeep • Significant scrutiny on cross border transactions • Maintaining local secretary compliance and documentation standards |

Singapore | • Requirement for at least one local resident director • KYC intensity for banking setup • Need for filing constitution and appointing a corporate secretary within set deadlines | • Annual Return and AGM requirements • Tight timeline sensitivity on director or shareholder changes • Increasing compliance with beneficial ownership and filing of Register of Controllers |

Japan | • Need for resident director or representative • Complex incorporation documents in Japanese • Capital contribution documentation requirements • Limited English support across government processes | • Highly formal board and shareholder meeting minutes • Strict labor and social security filings • Multi step reporting for even minor company changes • Relatively slow government processing times |

China | • Multi step approval process with several government bureaus • Need for registered capital plan • Legal representative risk and liability • Inconsistent interpretation by local authorities | • Mandatory monthly tax filings even with no revenue • Labor contract and social insurance compliance is rigid and heavily enforced • Annual combined report across multiple authorities • Difficulties changing legal representative or deregistering entity |

India | • Director Identification Number (DIN) and Digital Signature Certificate (DSC) requirements • Need for local registered office • Multi step incorporation with MCA and PAN TAN registrations • Bank account opening delays | • Monthly GST and TDS filings • Mandatory board meetings, AGM timing, and detailed minutes • Strict payroll withholding rules • Frequent regulatory updates and system changes • High exposure to late fees and penalties |

South Korea | • Resident manager or representative required • Korean language filings • Need to register with multiple agencies for tax and social insurance • Bank compliance hurdles | • Monthly VAT and payroll filings • Rigid labor law compliance and severance accruals • Annual business registration updates • Mandatory in country bookkeeping and audited financials depending on size |

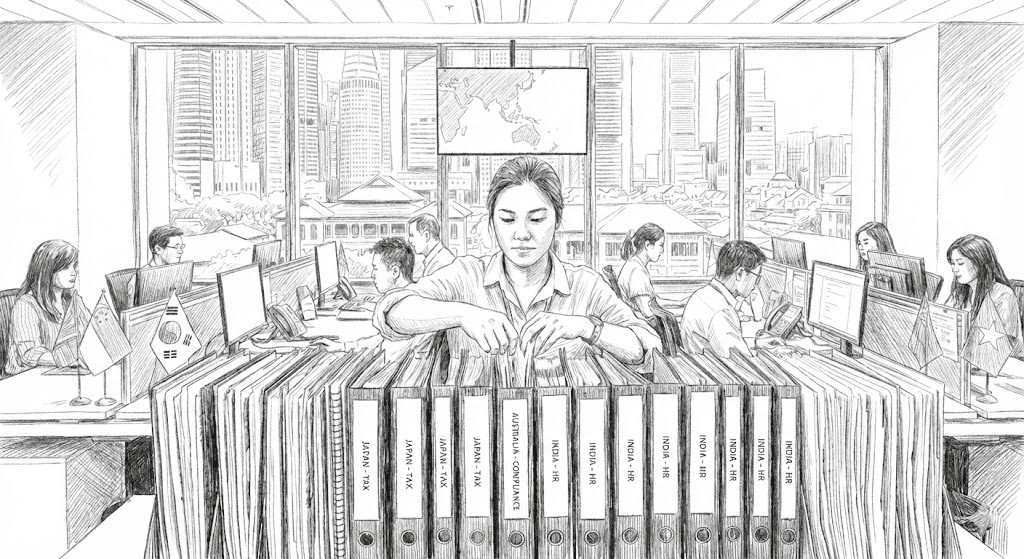

A Patchwork of Jurisdictions With No Harmonized Framework

The first and most persistent challenge is structural. APAC is not a regulatory bloc; it is a collection of more than a dozen major economies, each with its own legal history, corporate law tradition, filing calendars, and administrative norms. Operating in Singapore does little to prepare a company for navigating Indonesia or India. Hong Kong’s corporate governance standards share almost nothing with Vietnam’s. Even within federal systems such as Australia or India, state level requirements introduce another layer of fragmentation.

For companies overseeing multiple subsidiaries, there is no single standard playbook. Every jurisdiction becomes its own compliance track, its own set of annual filings, its own board resolution requirements, its own nuances on capital maintenance and statutory registers. What might be centralized elsewhere must be recustomized repeatedly across APAC markets.

Manual Processes and Bureaucratic Friction

While Western markets have largely digitized entity administration, many APAC governments still rely heavily on manual, paper based processes:

Wet ink signatures remain the norm

Notarization and legalization are frequent requirements

Corporate changes may require in person appearances

Local representatives or resident directors are often mandated

Government portals may be unstable or lack English language support

Routine events such as appointing a director, updating a registered address, or resolving a share issuance can stretch into weeks. For global teams accustomed to electronic filings and predictable timelines, the region introduces unfamiliar friction.

Regulatory Volatility and Uneven Enforcement

APAC’s policy environment is also less static than in Europe or North America. Regulatory agencies in markets such as India, China, Indonesia, and the Philippines often issue new circulars, guidance, or reporting formats with limited advance notice. Tax authorities in particular adopt evolving interpretations of permanent establishment rules, transfer pricing thresholds, and payroll compliance standards.

Enforcement can be inconsistent but when applied, more punitive. Late fees escalate quickly, dormant entities are struck off with little warning, and compliance missteps can trigger tax audits that extend beyond the subsidiary in question. The unpredictability creates both operational risk and cost overruns.

Talent Constraints and Vendor Variability

Another obstacle is the uneven quality of corporate secretarial and compliance professionals across the region. In Singapore and Hong Kong, the market is mature and standards are high. But in emerging markets, companies may encounter:

Limited English language documentation

Vendors reliant on messaging apps and email for recordkeeping

Inconsistent interpretation of statutory rules

Slow turnaround times due to staffing shortages

This variability forces headquarters teams to spend disproportionate time coordinating local accountants, company secretaries, and lawyers, effort that seldom scales smoothly as more markets are added.

Tax and Employment Complications That Spill Into Entity Governance

APAC’s complexity is not purely administrative; tax and employment rules frequently intersect with entity management. Hiring an employee in India without proper local payroll registration, or managing contractor payments in the Philippines without withholding compliance, can retroactively expose the parent entity to penalties or even tax nexus risk. In many jurisdictions, corporate governance, employment law, and tax obligations are interdependent, making siloed management impossible.

Why Companies Underestimate the Risk

Global firms, especially those headquartered in the United States, often underestimate the challenge because they assume entity management is commoditized. But in APAC, entity administration is not merely a back office function. It is a critical operational capability that affects:

Market entry speed

Human resources and payroll compliance

Tax exposure

Banking access

Investor reporting

Reputation with regulators

Many discover the complexity only when a filing is missed, a director change stalls a banking approval, or a dormant entity is struck off unexpectedly.

The Strategic Cost of Getting It Wrong

The consequences of mismanaging APAC entities go beyond penalties. A compliance breach can derail fundraising, delay cross border payments, restrict dividend repatriation, or complicate an exit due diligence process. As private equity investors increasingly scrutinize governance hygiene, the cost of poor entity management becomes more strategic than administrative.

The Companies That Succeed Do Three Things Well

The organizations that avoid these pitfalls tend to:

Centralize control through technology while respecting local differences

Select strong, proven local partners rather than relying on lowest cost vendors

Implement regional governance frameworks early rather than reactively

In APAC, proactive structure beats reactive cleanup every time.

A Region of Opportunity But Also of Administrative Complexity

APAC remains a magnet for global growth. But beneath the economic momentum lies a compliance landscape that demands rigor, local fluency, and operational discipline. Companies that treat entity management as an afterthought risk encountering some of the most avoidable yet costly setbacks in international business.

In a region where regulatory nuance can shape market access, good entity governance is not only protection. It is competitive advantage.